salt tax impact new york

Starting with the 2018 tax year the maximum SALT deduction available was 10000. The Rockefeller Institute of Government and the New York State Division of the Budget have examined the impact of the SALT cap.

Home Related Tax Deductions That Benefit New Yorkers Work Live Apartments Available Now Cityrealty

The cap disproportionately impacts expensive high-tax Blue States including New York where its exacerbated the effect of.

. Enacted by the Tax Cuts and Jobs Act in 2017 the SALT cap has been a pain point for filers in high-tax states such as New York and New Jersey. 21 hours agoRemember how House Democrats from New Jersey and New York vowed to oppose a tax-and-spending bill that didnt lift the 10000 deduction limit for state-and-local taxes. And some lawmakers have been fighting to include a.

With the SALT limitation in place New Yorkers who already send 40 billion more in taxes to federal coffers than the state receives in return face the manifestly unfair risk of being taxed twice on the same income Nadler said. After legislators realized the impact of this it was decided to simply reduce the SALT deduction to 10000. Sarah McGahan JD LLM.

Financial Consultant Financial Services Tax Manager. Enacted through the Republicans 2017 tax overhaul the SALT cap has been a pain point for costly states like New York and New Jersey because residents cant deduct more than 10000 in state and. And to 633 for those in the next income tax bracket which ranges up to 323200.

However the other beneficiaries of the SALT deduction are high tax states such as New York California New Jersey and Illinois. This report shows that the cap which is effectively a tax increase for New Yorkers is having a sustained negative effect on employment and output in New York State. Dozens of House Democrats from California New York and New Jersey have spent years arguing that the limits on the state and local tax deduction known as SALT included in the 2017 Trump administration tax cut package amounted to a big tax increase on middle-class families in areas with either high real estate prices high state and local.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021. Dozens of House Democrats from California New York and New Jersey have spent years arguing that the limits on the state and local tax deduction known as SALT included in the 2017 Trump administration tax cut package amounted to a big tax increase on middle-class families in areas with either high real estate prices high state and local taxes or both.

The New York executive budget legislation for fiscal year 20142015 was signed by Gov. As New York State reckons with the vast economic impact of COVID-19 including a workforce depletion of. For your 2021 taxes which youll file in 2022 you can only itemize when your individual deductions are worth more than the 2021 standard deduction of 12550 for single filers 25100 for joint filers and 18800 for heads of household.

For example in 2017 the average SALT deduction in New York was 23804 compared to just. The 10000 limit on the amount of state and local taxes deductible from federal income was enacted in 2017 and sunsets after 2025 under current law. 52 rows The SALT deduction is only available if you itemize your deductions using Schedule A.

For joint filers the personal income tax rate would drop in the 2021 tax year to 597 for those earning between 43000 to 161550. New York supports 107000 fewer additional. About 10 percent of tax filers with incomes less than 50000 claimed the SALT deduction in 2014 compared with about 81 percent of tax filers with incomes exceeding 100000 the Tax Policy.

With a SALT deduction in place as states and localities increase taxes the deduction becomes more valuable for itemizers. Job in New York City - Richmond County - NY New York - USA 10261. Unchanged is the SALT state and local income tax deduction cap.

New York would legalize mobile sports betting. Much has been said and written about the corporate tax reform measures and their potential impact on various taxpayers. Andrew Cuomo on March 31 2014.

The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. The SALT cap increase will have the biggest effect on high-income-tax states like New York California and New Jersey said certified financial planner Matthew Benson owner at Sonmore Financial. This consequential tax legislation available to electing pass-through entities provides a mechanism for New York State individual taxpayers to limit the impact of the.

It appears one of the goals of this legislation was to improve the. On a most superficial level it might seem obvious that the TCJA provision capping state and local tax SALT deductions at 10000 would have to represent a tax increase for many middle-class residents of high-taxed states like New York where property taxes on a downstate suburban house can approach or exceed the limit.

Appeals Court Rules Against States Challenging Salt Deduction Cap Route Fifty

Can New York Be Saved In The Era Of Global Warming Rolling Stone

New York S Passthrough Entity Tax Cla Cliftonlarsonallen

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Brad Lander

Updated Guidance The Pass Through Entity Tax In New York State Overview And Faq Marks Paneth

New York Property Tax Calculator 2020 Empire Center For Public Policy

New York State S New Pass Through Entity Tax The Cpa Journal

Ny State Pass Through Entity Tax Can Save You Up To 40 8 Perelson Weiner

Nyc Home Prices Plunge After Salt Deductions Capped

What S The New York State Income Tax Rate Credit Karma

Highlights Of The New York State Pass Through Entity Tax Prager Metis

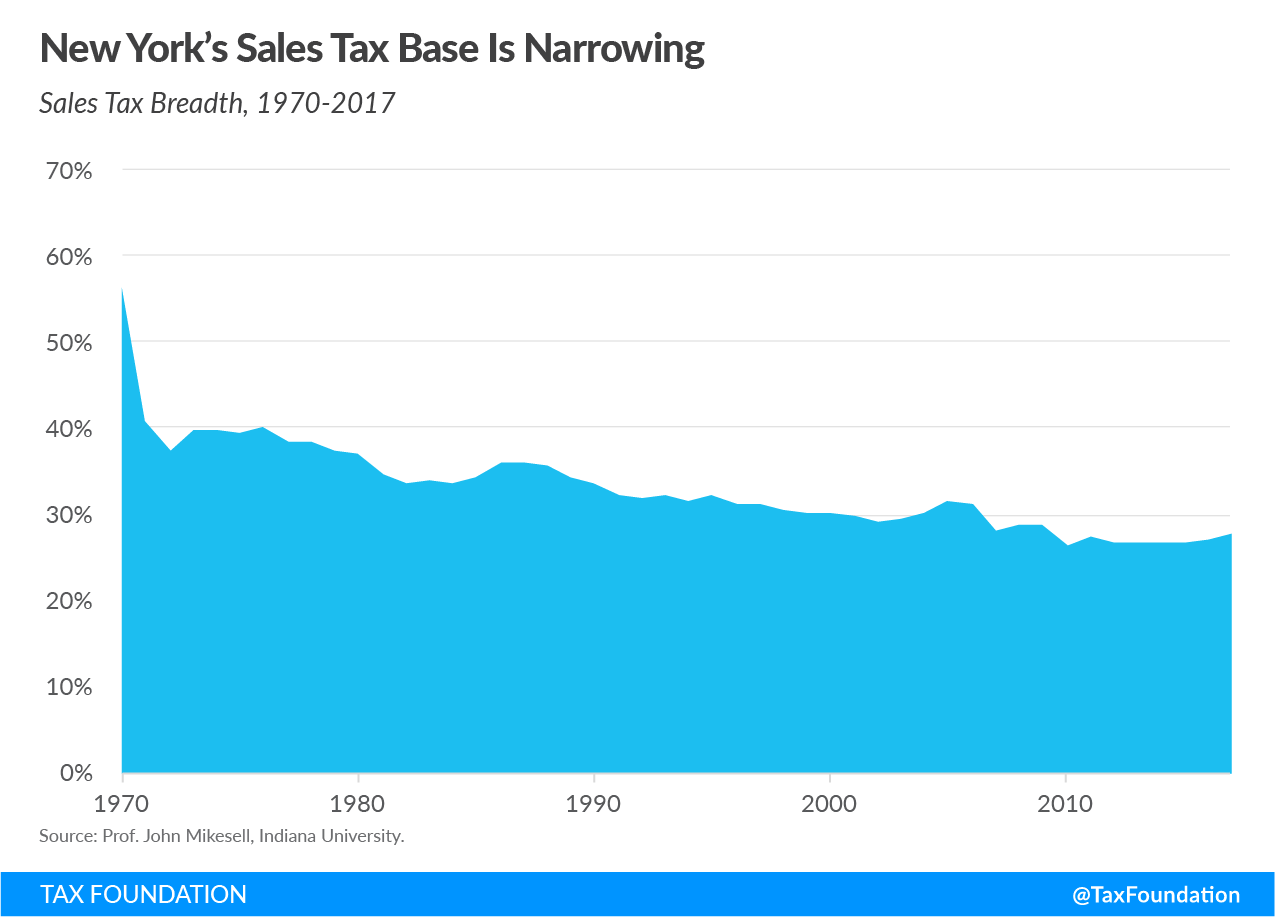

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

/StateandLocalTaxCapWorkaround-1bbc2598e0144769b6e2542e11d22839.jpg)

State And Local Tax Cap Workaround Gets Green Light From Irs

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

New York State Pass Through Entity Tax Election Period Is Open For 2022 Wolters Kluwer

Comments On New York City S Executive Budget For Fiscal Year 2023 And Financial Plan For Fiscal Years 2022 2026 Office Of The New York City Comptroller Brad Lander

New York Governor Signs 2022 2023 Budget Marcum Llp Accountants And Advisors